The two tales of the agrochemical market

The domestic agrochemical market is better placed while issues persist on export front.

Highlights:

-

- Domestic agrochem demand remains robust

-

- International markets continue to face a double whammy

-

- Input prices have bottomed out

-

- Dhanuka maintained its FY24 guidance

- Glyphosate verdict adds to Sumitomo’s worries

The agrochemicals market is slowing normalising, though the situation varies from market to market and product to product. We are positive on Dhanuka Agritech, but cautious on Sumitomo Chemicals India.

Dhanuka Agritech (DAL; CMP: Rs 1047; Market cap: Rs 4,772 crore; Rating: Overweight)

Growth strategy is on track

Dhanuka commenced operations at its new plant in Dahej in Aug’23 and started the production of bifenthrin technical. The company had earlier indicated a top-line contribution of around Rs 50 crore from this plant in FY24 and a higher contribution in FY25 as utilisation improves.

Dhanuka will also be using some of the technicals from the Dahej plant for captive consumption and nearly 10 percent cost savings could be expected.

Well managed product portfolio

Delayed and uneven monsoon dampened domestic agrochemicals demand in Q2FY24. In a difficult market, where most players saw their sales tumble, DAL’s revenues came in 14 percent higher year on year (YoY), chiefly led by volumes.

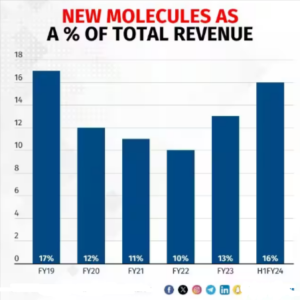

Volumes improved on the back of a better product mix which can be seen in Dhanuka’s innovation turnover index that stood at 16 percent against the 5-year average of ~13 percent.

In H1FY24, DAL launched two 9(4) molecules, one 9(3) product, and one co-marketing product. Additionally, its product ‘Decide’, introduced last year, supported revenue growth.

Going forward, the management aims to focus on the margin accretive 9(3) portfolio and targets to launch 8 products across 9(3) and 9(4) molecules in FY24-FY25 to drive growth.

Guidance maintained

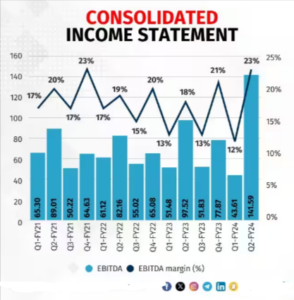

Dhanuka’s Q2FY24 saw a solid ~625 basis points (bps) and ~500 bps improvement in gross margin and EBITDA margin, respectively. This was primarily driven by a good product mix and the elimination of the carry-over inventory loss, which was experienced last year.

Price corrections have bottomed out and are stabilising for many products. Additionally, the management is seeing improved demand scenario at the farmers’ level and expects good demand from the eastern part of the country in H2.

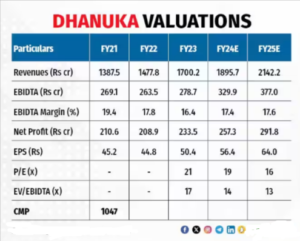

Given this backdrop, Dhanuka has reaffirmed its guidance for a double-digit revenue growth in FY24 (excluding contribution from the Dahej technical plant) and an EBITDA margin expansion of ~200 bps YoY.

Sumitomo Chemicals India: (SCIL; CMP: Rs 406; Market cap: Rs 20,280 crore; Rating: Under-weight)

Exports business remains a drag

The adverse weather conditions in Europe and LatAm has impacted the international markets leading to de-stocking by global manufacturers. Moreover, softening input prices and an oversupply of generic agrochemicals by China have led to significant price pressures.

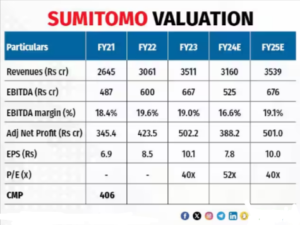

SCIL’s export revenue experienced more than 50 percent YoY decline in Q2FY24 as volumes and pricing both dragged this business by ~25 percent each.

Pricing pressure is driving margin pressure

Prices for specialty products of SCIL have been impacted by a marginal ~3 percent compared to a 15-25 percent decline seen in most generic products. SCIL is more oriented towards generic formulations exports, which account for 60-70 percent of its export revenue.

Glyphosate, which is SCIL’s key product, suffered a 25-30 percent drop in exports prices. Additionally, the large amount of carry-over inventory at the beginning of the year also doubled the pressure, thereby shrinking SCIL’s Q2FY24 EBITDA margin to 20.8 percent, a ~400 bps drop YoY.

The glyphosate verdict

The government notification on October 25, 2022 that glyphosate should be used only through pest control operators (PCOs) has been in paper for more than a year. After a court hearing held on December 7, 2023, the central government ha announced that the proposed notification will be implemented from February 15, 2024.

The company is aiming to diversify and is planning to launch several unique registrations in India. It is also focused on five proprietary molecules for the parent company SCC Japan, which could start contributing to the top line this fiscal.

Nonetheless, SCIL will face some heat of the domestic restriction of glyphosate along with the difficult exports situation.

Outlook and Valuation

The domestic agrochemical market may show gradual improvement as on-ground demand remains robust and pricing remains healthy for specialty products.

At the current market price, Dhanuka Agritech is trading at a P/E of ~16 times its FY25 projected earnings and remains inexpensive compared to its peers. We continue to remain over-weight on the stock.

However, we think it will take a while for the international market to turn more favourable in terms of volumes as well as realisations.

Exports, which constitute ~20-25 percent of SCIL’s revenues, high channel inventory in the generic segment, and pressure on its key product glyphosate keep us cautious on SCIL.

Given the multiple near-term risks, we are turning under-weight on Sumitomo Chemicals India (equal-weight previously), which is trading at a P/E of ~40 times its FY25 projected earnings.

Bymoneycontrol