Varun Beverages: Is there more fizz left after the run-up?

Focus on under-penetrated markets in India and higher growth rate in international geographies to drive earnings growth.

Key highlights

· Acquisition in South Africa

· Penetration-led growth remains the focus

· Large capex completion in India before season commences

· Remain positive and investors can add and accumulate stockVarun Beverages Ltd (VBL; CMP: Rs 1,172; Market capitalisation: Rs 1,52,147 crore; Neutral) has outperformed the Nifty 50 and FMCG index by a wide margin this year. It hit a life-time high of Rs 1,178 on December 19, 2023. VBL has been relatively insulated from the broad slowdown faced by other FMCG majors.

Higher growth in international geographies: Apart from India, VBL is present in Morocco, Zambia, Zimbabwe and Sri Lanka. It has also set up a 100 percent subsidiary in South Africa, where it no presence now.

VBL has some surplus capacity in Zambia and Zimbabwe, which can be used in adjoining Mozambique. Nepal and Sri Lanka have ample capacities to meet the company’s respective requirements.

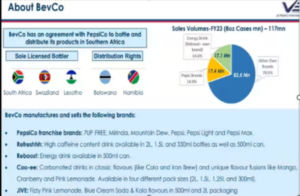

VBL has acquired a 100 percent stake in The Beverage Company (Proprietary) Limited, South Africa, along with its wholly owned subsidiaries.

The Beverage Co is engaged in manufacturing and distributing licensed (Pepsico Inc)/own branded non-alcoholic beverages in South Africa, Lesotho and Eswatini.

Further it has distribution rights for Zambia and Botswana. The acquisition is likely to be completed by July 31, 2024. The consolidated turnover for financial year June 30, 2023, was ZAR 3,615 million and the enterprise value (EV) for the transaction is valued at ZAR 3 billion (Rs 1,320 crore; transaction valued at 1.2x EV/sales).

The Beverage Co has five manufacturing facilities – two in Johannesburg and one each in Durban, East London and Cape Town.

Soth Africa is the largest soft drink market in Africa and has one of the highest per-capita consumption rates. Its total population is 60 million, out of which 65 percent is in the 15-64 age group and the urbanisation level is 60-80 percent.

Higher distribution reach, compared to FMCG players: India has nearly 12 million retail outlets, of which VBL covers about 3.6-3.7 million outlets. This leaves room for higher penetration and volume growth. VBL is adding 2-3 lakh stores annually, and with higher electricity reach, new store additions will be aided by higher refrigeration. VBL has also invested in visi coolers and has already installed 9.25 lakh visi coolers. It is planning to install more in the coming years.

Investing in capacities, readying for higher growth: VBL is planning to increase capacity by 40 percent from the 2022 levels, both greenfield as well as brownfield. The increase in capacities is likely to begin before the season begins around March 2024.

Along with carbonated drinks, VBL will be focusing on value-added dairy segment and fruit juices. Growth in carbonated drinks will be further accompanied by energy drink, under Sting, Nimbooz and other sports drink.

Nimbooz grew by 100 percent, Gatorade by 70-80 percent while Sting (energy drink) has done strongly in the September 2023 quarter. The dairy segment will start contributing to growth from January 2024 as new capacities come in. There is also an increasing focus on its non-sugar portfolio, which could provide a healthier alternative to consumers.

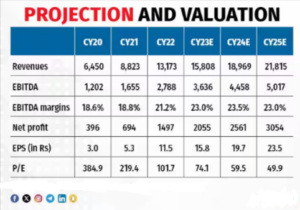

The capacity is likely to increase in India by 45 percent over 2022. The management has guided an asset turn of around 1.8x-1.9x at peak utilisation level and the total capex, put together, will be Rs 2,500 crore. Assuming everything remaining the same, that should result in almost 40 percent growth in revenues from CY22 consolidated revenues.

Outlook and valuations

We remain positive on VBL, after this South African acquisition. International geographies are likely to witness higher growth rate and seasonality issues are likely to come down further. India remained a largely under-penetrated market for carbonated drinks, and VBL has started to invest in visi coolers and bottling plants near its targeted markets. VBL was the market leader in north India and started penetrating into south and west India. We expect double-digit volume growth for VBL, thanks to the new capex coming in.

Bymoneyc0ontrol

Insidesmarket.com