Suryoday Small Finance Bank: Why this stock is for risk-takers

Portfolio diversification, lower credit cost and operating leverage remain key drivers to ROA.

Highlights:

-

- High concentration towards risky assets

-

- First half performance was robust

-

- Loan growth momentum maintained

-

- Rising deposits, but low traction in CASA

-

- Interest margin to moderate

-

- Stabilizing asset quality, sharp reduction in fresh slippages

- Valuation at a discount to peers

Post the Covid-led turmoil,

Suryoday Small Finance Bank’s (Suryoday SFB, CMP: Rs 155 Market Cap: Rs 1,640 crore Rating: Over-weight)

recent performance has been resilient with improvement across operating metrics.

Prior to commencement of operations as SFB in 2017, the bank operated as an NBFC MFI, carrying out micro-finance operations. Covid lockdown deeply affected the lending operations of the bank, driving higher provisioning costs on the back of sharp deterioration in the asset quality. The period saw rising slippages (GNPA ratio rising to 11.8 percent at the end of FY22 from 1.8 percent in FY18). However, with improved macros, the bank wrote-off legacy loans and restructured a large chunk of non-performing assets in FY23.

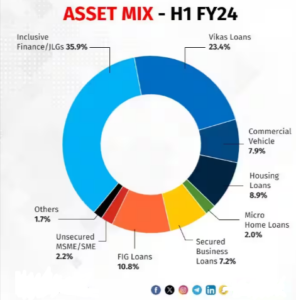

Apart from the risky business model (about 62 percent of loan book is unsecured), weak deposit profile (low CASA share) also add to concerns.

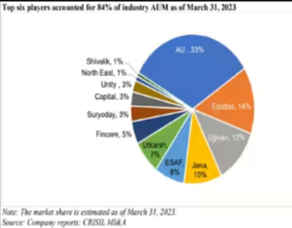

However, with access to low-cost funds and huge cross sell opportunity, the bank is planning to capitalise on the huge market opportunity (Bank’s market share is 3 percent), and expects to log higher asset growth as they tap newer geographies.

Quasi-secured product portfolio comes at a cost

The unsecured product portfolio, including Inclusive Finance and Vikas loan (launched in 2020) is covered under the credit guarantee scheme, and is costing the bank around 2.1 percent of the covered portfolio (80 percent) over a two-year period.

Vikas loan is the bank’s flagship product, offered to the bank’s graduating JLG customers (joint liability group). The bank plans to increase its share to 36 percent (currently 23 percent of the loan book).

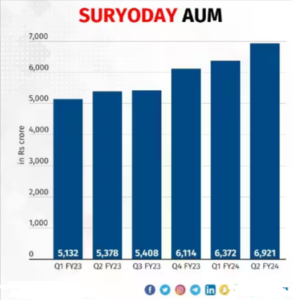

Asset displayed consistent growth momentum across cycle

Gross loan portfolio is growing at a 5-year CAGR of 29 percent, in line with the industry average.

Overall advances grew by 32 percent YoY in the H1 FY24, primarily driven by strong growth in disbursement (up 43 percent YoY in Q2) led by Vikas loan (up 139 percent YoY) and commercial vehicle loan products. Higher growth is expected in the seasonally better second half of the fiscal.

Steady growth in deposit, but profile continues to remain weak

Overall deposit base had more than doubled in the past two years, with above industry-average retail deposit share (78 percent at H1 FY24 end).

Although, elevated credit-to-deposit ratio levels persisted (CDR at 105 percent in Q2), deposit growth had outpaced credit growth.

However, the bank need to focus on increasing the share of low-cost CASA (current account and saving account) while scaling up the deposits. The bank’s CASA ratio has been declining, and remains below industry-average at 15.7 percent.

Stabilised asset quality, improved credit cost

Diversification of product mix into relatively less risky assets, write-off of legacy loans and lower slippages led to sharp drop in GNPA ratio in FY23, and the momentum continued in the H1 FY24.

Also, credit cost decreased on lower provisioning (below 2.5 percent in H1 FY24) and is expected to improve further.

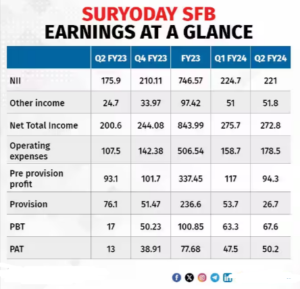

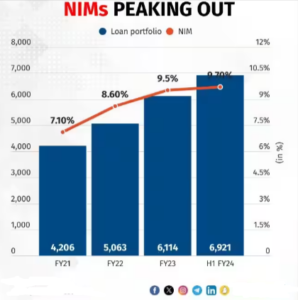

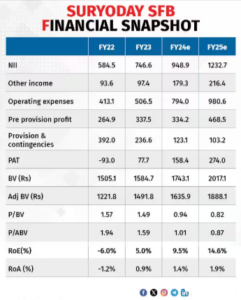

Lower provisioning boosted overall profitability, NIMs to moderate

The bank posted promising early-year performance with sustained robust profits (H1 FY24 PAT stood at Rs. 98 crore versus Rs. 78 crore in FY23) and stable margins, despite higher cost of funds.

Consequently, return on asset witnessed sharp upswing (up from 0.9 percent in FY23 to 2 percent in H1 FY24), primarily driven by higher other income (Rs. 500 crore of new business) and sharp drop in credit costs.

However, net interest margin (NIM) will likely moderate with increasing share of less risky assets in the near-term. This coupled with elevated operating expense on account of credit insurance expenses and higher branch additions (30 to 35 branches by FY24) will put pressure on overall profitability.

That said, operating leverage and lower credit cost will aid ROA improvement in the coming fiscal.

Outlook

The bank is following a three-pronged strategy for growth – deeper penetration, contiguous branch expansion, and building a granular retail book.

Moreover, it plans to scale micro-home loans with an intent to increase its share to 7 percent of the loan book (currently 2 percent). The product offer higher yield in the 17 to 18 percent range.

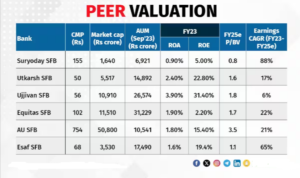

Attractive valuation

The stock trades at 0.8 times its FY25e P/BV, and Suryoday SFB deserves a higher valuation, which indicates room for a strong upside.

Although, product concentration towards unsecured lending makes the business model risky, but the risk is worth taking given improved macros and attractive valuation.

Bymoneycontrol