Should investors subscribe to Aadhar Housing Finance’s IPO?

The company is well poised to leverage the growth opportunities in affordable housing finance segment.

Highlights

-

- Largest affordable housing finance player in the country

-

- Backing of marquee promoter, more than adequate capital

-

- Reasonably good asset quality, though borrower segment is highly vulnerable

-

- Diversified funding sources, strong profitability

- Sector tailwinds make Aadhar a good bet

Aadhar Housing Finance’s initial public offering (IPO) of Rs 3,000 crore opens for subscription on Wednesday, May 8. The issue consists of Rs 1,000 crore of fresh capital in addition to an offer-for-sale from the promoter (Blackstone) amounting to Rs 2,000 crore.

Aadhar is backed by global investment firm Blackstone Group that infused Rs 1,300 crore of equity capital in the company after acquiring it from the earlier promoters (Dewan Housing, Wadhawan family) in 2019. Blackstone’s equity stake in Aadhar will reduce from 98.75 percent to 76.5 percent following the IPO.

The IPO of the housing finance company (HFC) is coming at a time when activities in the primary market are at its peak. Given the euphoria, the issue is likely to pull in a large number of investors and is likely to see listing gains. But the current exuberance in the primary market is not the only reason to consider Aadhar.

Aadhar operates in the affordable housing segment (smaller loan ticket size up to Rs 15 lakh) that is in a sweet spot due to the government’s focus and is the fastest-growing sub-segment for HFCs. That said, the competition has been stiff with many new entrants in the past few years. What then differentiates Aadhar from other affordable housing finance players?

First, Aadhar is the largest player in the affordable housing finance space with assets under management (AUM) of Rs 19,900 crore as of Dec ’23. While there are many players, achieving a scale in terms of loan book size is a tall task in a hyper-competitive segment. Aadhar has not only scaled up the business but have also done so along with reasonable asset quality and healthy return ratios.

Second, the company has developed a well-entrenched franchisee on a pan-India level. Aadhar has a relatively large diversified geographical presence than other players in the affordable housing finance segment.

Last but the most important draw is the valuation of the IPO. Aadhar’s IPO is priced at a discount to other listed players and leaves value on the table for investors.

Brief about the company

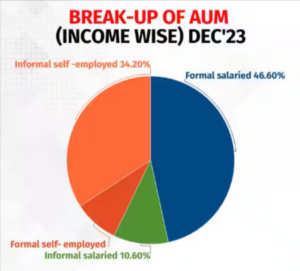

Aadhar targets home buyers in economically weaker sections (EWS) and low-income groups (LIG). These segments constituted around 73 percent of the AUM as of December’23. Its customer segment includes self-employed and salaried customers, who have limited access to formal lending channels in the absence of proper income documents and/or limited credit history. Salaried customers contributed around 57 percent of the AUM at the end of December’23. Within the salaried customer segment, the formal segment (customers who have a documented monthly salary typically credited directly to their bank accounts) contributed 81.5 percent of the AUM as of December 31, 2023, while the remaining AUM is from the informal segment (customers that receive a monthly salary that is not supported by documentation and may be paid in cash).

The average ticket size of the company’s loans stood at Rs 10 lakh with an average loan-to-value of 58 percent as of December’23.

The company’s operations are geographically diversified and spread across 487 branches covering 533 districts across 20 states serving 256,000 live accounts.

The share of the top two states (Uttar Pradesh and Maharashtra) stood at 27.6 percent of the AUM with no state accounting for more than 14 percent of the AUM as on December 31, 2023

Strong loan growth despite high base

Aadhar’s AUM has grown at a compounded annual rate (CAGR) of 17 percent from FY18-FY23. The lender continues to scale up its operations and its AUM has increased by 20 percent YoY to Rs 17,233 crore in 9M FY24. Around 76 percent of its AUM comprised home loans secured largely by self-occupied residential properties, while the remaining is loan against property (LAP).

Aadhar’s borrowings are predominantly in the form of bank loans, NHB (National Housing Bank) refinancing facility, and capital market instruments, including subordinated debt. Post the change in ownership and with Blackstone at the helm of the affairs, Aadhar has been able to raise funds regularly from various sources. It has borrowed funds from about 21 public and private sector banks (including NHB). The funding cost benefits from NHB as the lender, which offers funds at significantly lower rates than the market.

Benign asset quality but vulnerable borrower profile

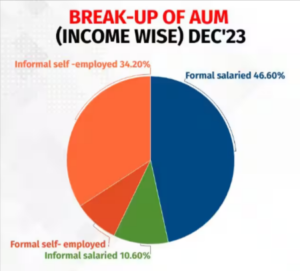

Aadhar’s asset quality is resilient with gross non-performing assets (GNPA) below 2 percent, supported by its prudent underwriting practices and robust collection infrastructure. The collection efficiencies (including overdue collections) have improved after dropping to around 91 percent in April 2021 during the Covid wave. The company’s restructured book has been initiated with normal repayments.

While the lender has been able to maintain good asset quality, the low-income group borrower segment adds to the overall portfolio vulnerability.

Strong profitability

Despite the systemic hardening of interest rates, the cost of funds remains low on the back of the increasing share of low-cost funding from NHB. Further, with the growing share of the relatively higher-yielding non-home loan portfolio and the increase in the lending rates, the company has been able to improve its spread. Operating expenses has been rising as the company continues to open new branches and hire personnel to support its growth plans.

Aadhar’s profitability has been improving aided by higher margins and low credit costs. The company posted an ROA (return on assets) of 4.2 percent and an ROE (return on equity) of 18.4 percent in 9M FY24.

Aadhar well placed in high growth focused segment

Over the medium to long term, affordable housing segment is anticipated to continue to grow at a very high rate. Rising urbanisation, increasing nuclear families, and improving affordability are converting latent demand for affordable houses into a commercially lucrative business opportunity for HFCs. More importantly, several initiatives of the government (interest subvention scheme, tax incentives, housing for all, infrastructure status accorded to affordable housing, PMAY) along with the regulatory push (priority sector status, lower risk weights on small ticket size loans) will further expand the growth of this sub-segment.

Given the structural growth in the segment, Aadhar’s loan book can grow at more than 20 percent per annum despite the relatively large book, While delinquencies can rise because of high growth, the high lending yield in the segment (above 12 percent) is expected to offset higher credit cost to a large extent.

Overall, we see healthy earnings growth sustainable on the back of HFC’s differentiated positioning and enough growth potential in the segment.

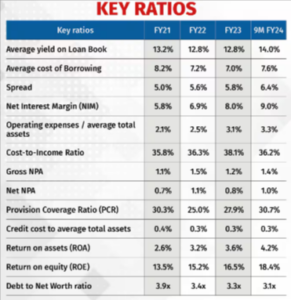

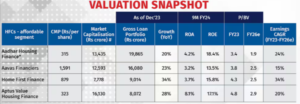

Valuation undemanding, given strong return ratios

At the upper end of the price band, i.e at Rs 315 per share, Aadhar is valued at 1.9 times estimated book value for FY26 on post money basis. For a HFC with a healthy earnings growth potential and ability to generate an ROA above 2.5 percent, the valuation seems quite reasonable.

On a relative basis, valuations look undemanding when compared to other listed affordable players. in the near term we see strong earnings growth to drive the stock upside. In medium to long term, valuation multiple can expand if it can sustain the profitability along with the scaling up of the franchise.

Given the marquee promoter backing, professional management, and a well-capitalised balance sheet, Aadhar is well poised for growth in the affordable housing finance space. It is a good long-term bet available at a reasonable price. We recommend investors to subscribe to the IPO for the long term.

Bymoneycontrol