Vijaya Diagnostic Centre: Sustaining strong margin profile

Prudent strategies are in place to expand in the eastern and western regions of the country.

Highlights

-

- Strong revenue & EBITDA growth in Q4

-

- New centres are ramping up well

-

- Newly acquired PH Diagnostics is contributing positively

-

- Successful expansion into new areas will be key for margins

Vijaya Diagnostic Centre (VDC; CMP: Rs 730; Market Cap: Rs 7,474 crore; Rating: Overweight) maintained its 40 percent margin profile in Q4FY24.

Test volumes trend remains solid and there isn’t much dependence on price hikes for overall growth. Vijaya is getting good traction in the new markets of West Bengal and Pune.

Strong earnings in Q4

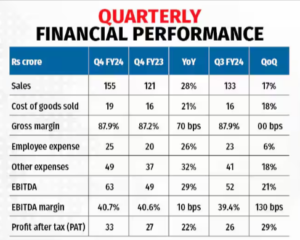

Q4FY24 revenue rose 28 percent year on year (YoY) to Rs 155 crore. On a like-to-like basis (excluding PH), revenue was up 18.5 percent YoY. Q4 performance was largely driven by growth in volumes across geographies, along with certain specialised tests witnessing price hikes.

Total test volumes increased by ~24 percent YoY, while revenue per test was up ~3 percent YoY.

The recently acquired PH Diagnostics, which is one of the largest diagnostics chains based in Pune, has been contributing positively to Vijaya’s financials. Its operating margins are in line with those of Vijaya, thus leading to a steady, consolidated EBITDA margin of 40.7 percent in Q4.

The hub centre in the Tier II town of Mahbubnagar broke even in 6 months of its operations, as targeted by the company. That, along with the ramp-up of hubs in Rajahmundry and Tirupati, together contributed to the improved performance in the quarter.

Wellness diagnostic packages, which are largely preventive test packages, stood at 14 percent of the revenue mix, compared to 13 percent last year.

Guidance is assuring

Vijaya maintained a solid cash conversion (CFO/EBITDA) ratio of 83 percent in FY24. It remains a debt-free company and had cash and liquid investments worth Rs 182 crore at the end of FY24.

It plans to incur a capex of ~Rs 200-220 crore over the next two years, of which ~Rs 120 crore will be spent for Pune expansion.

The management remains confident of maintaining ~40 percent EBITDA margin in its core operating regions of south India. It is also optimistic on generating good cash flows, going forward, to fund all the expansion projects through internal accruals.

Outlook remains positive

Going forward, the company plans to grow through the hub-and-spoke model by adding ~15 centres (including 3-4 hub centres) in the next few years.

It has been successfully operating two hub centers in Kolkata, which should break even by Q2FY25. Two more hubs are planned for Kolkata to meet the fast-growing demand in the West Bengal region.

Vijaya has also ventured into Karnataka with its newly launched hub center in Gulbarga and expects to expand its footprint in this adjacent geography as well.

PH diagnostics posted a turnover of ~Rs 44 crore in FY24, up 5 percent YoY. Vijaya is currently focused on ramping up its Pune expansion and plans to fully integrate the company by the end of Q1FY25. Given that its margins are in line with those of Vijaya, this acquisition will be a value-add to widen its reach in the western market.

The stock has rallied ~95 percent in the last one year, performing way better than its pathology peers. However, it’s trading at 24x EV/EBITDA FY26e, which is at par with these peers.

Given a strong regional presence, prudent expansion strategies, healthy balance sheet and solid demand momentum, we think the valuations are quite reasonable and the stock has a lot of room on the upside.

Bymoneycontrol