Will the FPIs pour more money into India, post election results?

Continued policy support and economic stability can attract more flows from foreign investors.

Highlights

-

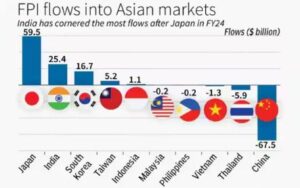

- India has received more FPI money than all other Asian markets (ex-Japan)

-

- India’s economic growth for 2023-24 is estimated around 8.2 percent

-

- FPIs to take some profits from India and shift the liquidity back into China

-

- S&P has upgraded India’s economic outlook to “positive”

- Addition of India government bonds in its emerging market indices would support flows

Foreign portfolio investors (FPIs) have been aggressive sellers in the domestic market, having sold over $4 billion of Indian equities in April and May, just ahead of the general election. In fact, the FPIs exhibited extreme caution with record net shorts in Index futures on the vote counting day (June 4), betraying a defensive instinct to protect and preserve their equity portfolios from an adverse outcome. The strategy worked well as the markets witnessed heightened volatility as the election outcome didn’t match the exit polls.

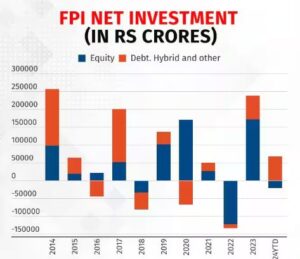

The recent turn of events majorly indicates some sort of event hedging as well as profit booking by savvy portfolio investors, especially post the steep run-up in indices, as net FPI inflows into equity totalled $20.7 billion in 2023, a three-year high. The primary drivers of FPI movement in India have been the market perception about the trajectory of Fed rates and the buoyant performance of domestic indices.

Considering the weakening trajectory of US inflation, market participants (traders as well as investors) seem to be factoring in the possibility of the first rate cut by the Fed later this year, possibly around September or October. Along with the expectations of a global monetary easing, the FPI flows have also been driven by the performance of the domestic economy, which has done well despite geopolitical conflicts, Covid, and elevated interest rates. India’s economic growth for 2023-24 is pegged at 8.2 percent, the highest among the large economies globally. Quite a lot of the growth is domestic-led, being driven by massive investment in infrastructure modernisation, particularly in the materials, real estate, and construction segments.

During FY24, India received more FPI flows than all other Asian markets, except Japan. China, on the other hand, has witnessed an outflow in 2022 and 2023 owing to concerns about a dull business environment, a shaky economic recovery, and rising geopolitical tensions. Along with this, a series of prolonged regulatory crackdowns on sectors — from technology to education — have also rattled domestic and foreign investors. While China has witnessed outflows of over $100 billion in the last couple of years, some of these flows have most likely made their way into India. Post the prolonged underperformance of the Chinese markets and reasonable valuations, we expect FPIs to take some profits from India and shift the liquidity back into China over the course of 2024.

However, the bullish long-term outlook will continue to attract secular FPI flows into the Indian markets in the coming years. Meanwhile, S&P Global Ratings has recently upgraded India’s economic outlook to “positive” from “stable” on robust growth prospects for the next three years and high public spending. Although India’s long-term sovereign rating has been retained at BBB-, there is a chance for an upgrade, provided the new government continues its agenda of reforms and policies, while keeping fiscal deficit under check.

The Bloomberg Index Services has announced that it will be adding Indian government bonds to its Emerging Market Local Currency Government Index from January 31, 2025. Along with this, JPMorgan has confirmed the addition of India government bonds in its emerging market indices. These moves signify that India’s financial market has matured and is now considered an attractive destination for international investors. More importantly, the inclusion of India in the global bond index opens the door for increased participation by foreign investors, thereby supporting business and trade activities through increased domestic liquidity.

While the inability of the Bhartiya Janata Party to achieve an absolute majority comes as a negative surprise to investors, the FPI equity and debt inflows will continue to be driven by progressive policy support and economic stability. Under the third term of Prime Minister Narendra Modi-led NDA, domestic and global investors are hopeful of an aggressive reforms agenda that can catapult India into the next orbit of growth. Although the PSUs have been the undoubted leaders of the current bull market, the continuity of the economic policy under the new government regime will encourage investors to broaden their portfolios beyond government-linked entities.

Bymoneycontrol

Insidesmarket.com