Esaf Small Finance Bank: What does this IPO offer for investors?

There’s room for listing gains, but the loan book remains predominantly unsecured and and the SFB is regionally focussed.

Highlights

-

- Well-timed IPO as the bottom-of-the-pyramid lender is coming out of the dark days of Covid

-

- Loan growth likely to accelerate

-

- Interest margin to improve with high-yielding loan book and lower interest reversal

-

- Drag from higher credit cost to wane as asset quality steadily improves

-

- Regional focus and product concentration make the business model risky

-

- A pro-cyclical play where earnings and valuation multiple will expand during up-cycle

-

- IPO valuation leaves money on the table for investors

-

- Long-term investors need to be aware that this isn’t an all-weather stock

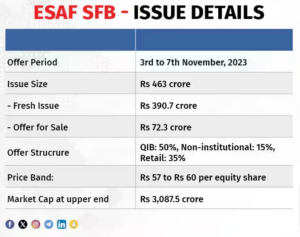

’s IPO, which is a mix of fresh issue and offer for sale, is well-timed as the lender is beginning to show strong growth and improved profitability after battling an asset quality crisis due to Covid. Rewards are going to be meaningful, given its relatively small size and the plethora of opportunities in the still underserved bottom-of-the-pyramid market amid an economic upswing. However, investors should not ignore the geographical concentration of the book and the predominantly unsecured loan book that remains vulnerable to a downturn. Having said that, the bankers have priced the issue at a discount to comparable peers, leaving room for listing gains.

Growth to remain resilient

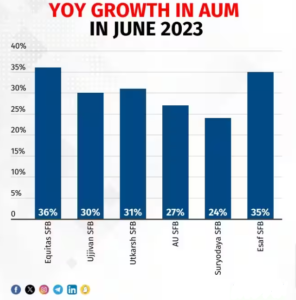

Esaf SFB has grown advances at a CAGR (compounded annual growth rate) of over 45 percent in the past six years. At the end of June 2023, total assets under management stood at Rs 17,204 crore, showing a year-on-year (YoY) growth of over 35 percent. Given the relatively small size and the large addressable underbanked/unbanked market that Esaf caters to, we do not see any near-term speed-breaker.

Margin to remain healthy

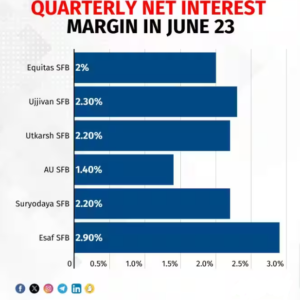

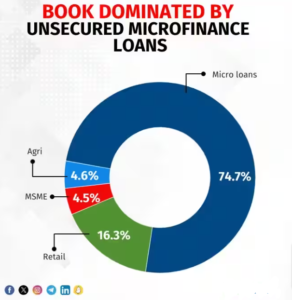

Since its conversion into a small finance bank (SFB) from its erstwhile avatar of an NBFC MFI, Esaf has carefully built a retail-centric deposit book where the share of retail deposits is over 89 percent and the book has grown at a CAGR of over 81 percent between FY17 and FY23. The recent struggle with deposits is reflected in the relatively modest 16 percent growth in June ’23 and the share of low-cost CASA (Current and Savings account) hovering around an unimpressive 18 percent. Nevertheless, thanks to a very high-yielding book because of the dominance of unsecured micro-finance, Esaf reported a quarterly net interest margin of 2.9 percent, the highest in the peer group.

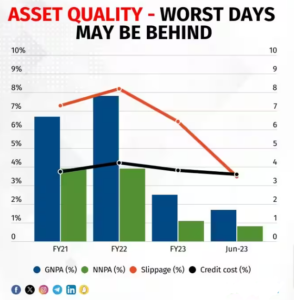

Worst of the asset quality is over

With a loan book loaded with unsecured micro-finance, Esaf had a tough going during Covid as livelihood came to a standstill for the majority of its borrowers. That resulted in a steep spike in gross slippage, while reported NPA shot up and credit costs hit the roof. However, much of the cleaning up is over, and the asset quality is back to pre-Covid level. Going forward, a normalised credit cost should support the expansion in return ratios.

What should still be a concern for potential investors

Esaf’s business model is no different from a typical NBFC MFI turned SFB. It is a high-risk/high-return model, where lending is typically unsecured with very high yield, resulting in an exceptionally high interest margin but with a high cost-to-income ratio as sourcing and servicing is costlier than mainstream borrowers. However, credit quality is extremely vulnerable to economic swing and credit costs exhibit periodic spikes. Earnings also tend to be volatile — strong economic cycle leads to healthy margin, lower credit cost and expansion in RoA; and in a down-cycle, margin is suppressed due to interest reversal and high credit costs further eat into the RoA (return on asset).

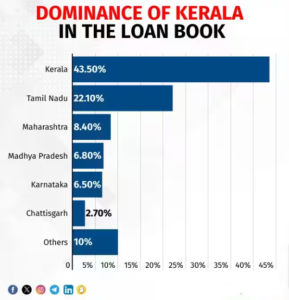

For Esaf, despite its effort to diversify, there is a significant regional concentration with its home state Kerala accounting for 43 percent of the book.

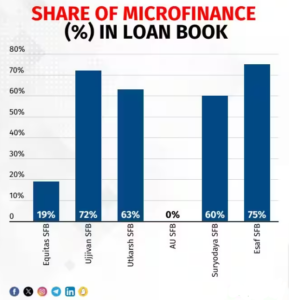

In terms of product concentration, with steady diversification into other retail products such as gold loans or mid-corporate lending, the share of unsecured micro-finance is down to 75 percent from 85 percent in 2021. But it still makes the book one of the most vulnerable with the highest share of unsecured in the peer group.

Why should investors look at this IPO?

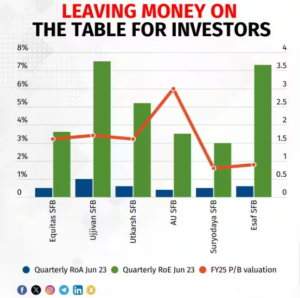

With positive economic momentum, the earnings quality is expected to improve with steady margin, falling credit cost, and an expanding RoA. This should support the expansion in valuation multiple. At the upper end of the price band, the issue values the company at 0.9x FY25e book, which is reasonable and at discount to peers with similar business models and return profiles.

So we do expect listing gains. However, unless the book becomes a lot more balanced with more secured products and geographical diversification, earnings could remain volatile. Hence, this is not an all-weather stock for a risk-averse investor for the long term.

Bymoneycontrol