Hero MotoCorp Q3 FY24: Premium launches improve performance

A substantial drop in raw material prices and operating leverage helped the bike maker.

Highlights:

-

- Demand, especially from rural areas, is improving

-

- Operating margin expanded on raw material cost correction and rich product mix

-

- Multiple launches across segments expected to help gain market share

-

- Focus on the premium bike segment and EVs could be key growth drivers

- Trading at a fair valuation.

(CMP: Rs 4,909; Mcap: Rs 98,139 crore, Rating: Equal weight) has reported notable improvement in operating margin during the third quarter of FY24. This improvement is attributed to a substantial decrease in raw material prices and operating leverage. The company’s top line has also experienced substantial growth, primarily fuelled by the introduction of new models in the premium segment.

Key highlights

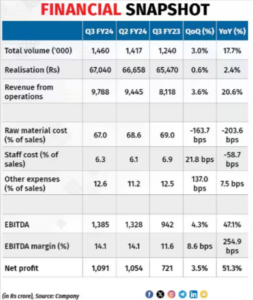

The company is seeing a surge in demand, particularly in rural areas, supported by the combination of renewed consumer interest and the introduction of new models in the premium segment. This, in turn, has resulted in a year-on-year (YoY) growth of 17.7 percent for the company. The net operating revenue has recorded a YoY growth of 20.6 percent, driven by a 2.4 percent increase in realisation.

In terms of operating profitability, there has been a significant improvement in the company’s EBITDA (earnings before interest, tax, depreciation, and amortisation) margin by 254.9 basis points. This improvement can be attributed to a favourable product mix and a correction in raw material costs.

Outlook

Demand is picking up

The management has conveyed that the challenging period of low demand is over, expressing optimism about a positive trend in demand across all segments, including both entry-level and premium segments. It is confident of a double-digit revenue growth for the industry in the coming year. Additionally, the demand from urban areas remains strong.

EV strategy – multiple products in pipeline

The company is actively exploring opportunities in the electric vehicle (EV) sector, which is anticipated to become a significant driver of demand in the coming years. With the successful launch of its EV vehicle, the company is achieving a weekly run rate of 1000 units.

In collaboration with Ather Electric, the company has initiated a partnership for an interoperable fast-charging network across India. The expanded EV network aims to encompass 100 cities, providing access to over 2,000 fast-charging points.

Moreover, the company has strategic plans to extend its EV presence to more than 100 cities in the near to medium term. To support this initiative, exclusive EV dealerships are being established, with the first one already operational in Pune. There are also plans to introduce multiple in-house EV products in the near future.

Portfolio expansion

Hero MotoCorp Limited (HMCL) has initiated a strategy to establish presence in the expanding premium motorcycle segment. The management’s approach involves introducing a comprehensive range of premium motorcycles before actively pursuing an increase in market share. The company has outlined plans to introduce several products across various segments, aiming to construct a robust premium portfolio.

The flagship Karizma XMR motorcycle, recently launched by the company, has already received an overwhelming response with over 13,000 bookings. Further, deliveries for the Harley-Davidson X440 have commenced nationwide. This segment is anticipated to remain a significant growth driver in the foreseeable future.

At the Hero World event in January this year, the company unveiled two more premium motorcycles — the Xtreme 125 R and the Mavrick 440.

Valuation at a fair level

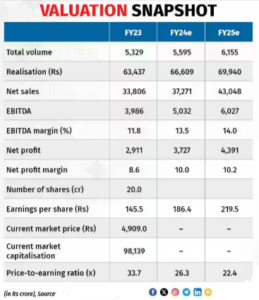

The stock price has surged 120 percent from its 52-week low recorded in March 2023, resulting in a valuation of 22.4 times the projected earnings for FY25. This valuation is considered fair. We, therefore, recommend investors to exercise patience and wait for a correction before considering it for inclusion in their long-term portfolio.

Risks

Any slowdown in demand could hurt financials. Moreover, adverse commodity price movements can increase raw material costs and hurt operating profitability.

Bymoneycontrol