Which housing finance stock is worth a bet?

Among the HFCs, affordable housing finance is the fastest growing sub-segment.

Highlights

-

- Shriram Housing Finance got a premium deal value from PE investor

-

- Stiff competition in affordable housing finance segment will lead to consolidation

-

- Affordable HFCs are in a sweet spot because of high growth rates

-

- Home First and India Shelter are among the fastest growing

- Repco Home and LIC Housing remain the most undervalued stocks in the sector

This month saw a big deal in the housing finance market. Warburg Pincus bought an 83.8 percent stake in Shriram Housing Finance (SHF) from Shriram Finance (parent company).

on May 13, 2024. The deal valued Shriram Housing Finance at Rs 4,630 crore, which translates to 2.4 times FY24 book value.

Shriram Housing Finance’s AUM (asset under management) touched Rs 13,762 crore as of end FY24 and has grown 4 times over the past three years, a CAGR (compound annual growth rate) of over 56 percent. SHF primarily operates in the affordable housing finance space and has an average loan size of about Rs 16 lakh.

So why did Shriram Finance exit the fast-growing affordable housing finance arm?

The sale of the housing finance subsidiary will strengthen the capital position of Shriram Finance, which seemed to be the key rationale behind the deal. Shriram Housing has been growing rapidly and needed capital to sustain growth. Moreover, the sale of HFC should help Shriram Finance to focus on its core businesses of financing commercial vehicles and small businesses that have higher profitability. Shriram Finance generated an ROA (return on assets) of 3.1 percent for FY24, significantly higher than Shriram Housing’s 2.2 percent.

Affordable housing finance set for consolidation

Affordable housing finance, which is typically loans with smaller ticket size of up to Rs 15 lakh, is the fastest growing sub-segment among HFCs and is set to grow at a CAGR of around 30 percent in FY24-25, as per Care ratings. The several initiatives of the government (interest subvention scheme, tax incentives, housing for all, infrastructure status accorded to affordable housing, PMAY) along with the regulatory push (priority sector status, lower risk weights on small ticket size loans) are driving the growth in this sector. Consequently, there is a huge capital need to fund this fast-paced growth.

The Shriram Housing Finance deal hints at the consolidation in the overcrowded affordable housing finance space. Despite the rising demand, one of the reasons for consolidation is stiff competition in the space. Moreover, the stringent regulatory requirements, almost in line with that of banks, do not leave much scope for regulatory arbitrage for HFCs.

While HFCs are facing huge competition from banks, affordable HFCs are still in a sweet spot.

That is because, affordable HFCs generally target self-employed and salaried customers in the informal segment who otherwise have limited access to banks in the absence of proper income documents and/or limited credit history. Also, they focus on small-ticket housing loans in rural and semi-urban areas. Banks need to focus more on large ticket loans because of their cost structure. There will always be a gap that can be addressed by niche affordable HFCs. This is precisely the reason we suggest investors to consider stocks of fairly valued HFCs.

The affordable segment offers relatively higher yields, given that customers are mainly from the unbanked, self-employed segment that has higher delinquency rates.

Most players in affordable HFCs have reported a decent set of earnings in the latest quarter (Q4 FY24). Collection efficiencies have improved and disbursements have picked up significantly. Moreover, the reasonable valuation offers a good risk–reward.

So then, which HFC offers best value?

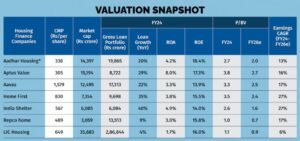

The valuations of the HFCs presents a picture of stark divergence. Home First and India Shelter are among the fastest growing companies, while Repco Home and LIC Housing remain the most undervalued stocks in the sector.

Our clear preference is for affordable players even though LIC Housing Finance, which is the largest player, is trading below estimated book value for FY26. For LIC Housing Finance, it is difficult to grow the loan book on a large base and return ratios are not so inspiring. The merger of HDFC and HDFC Bank highlighted that there is not much merit in operating as a standalone HFC if the size is very large. Rather, we prefer Repco Home Finance among the older players.

Among the affordable players, Home First is the preferred choice followed by Aadhar Housing Finance and India Shelter.

Home First started the year on a strong note, as the company crossed the Rs 10,000-crore-mark in asset under management (AUM), a significant milestone, led by branch expansion in core and emerging states of Uttar Pradesh, Madhya Pradesh, and Rajasthan. The management reiterated its AUM guidance of 30 percent and expects some NIM (net interest margin) compression with range-bound spreads (5-5.2 percent). However, continuous improvement in asset quality and benign credit cost will support ROA (return on asset) going forward.

With assets under management (AUM) of Rs 19,900 crore as of Dec’23, Aadhar is the largest player in the affordable housing finance space. Moreover, it has a relatively large diversified geographical presence than other players in the segment. And the most important draw is Aadhar’s valuation, which is at a discount to other listed players and leaves room for upside.

India Shelter’s AUM is growing at a four-year CAGR of more than 40 percent and is guided to grow in the 30-35 percent range through strategies like branch expansion and product diversification. The company’s ROA is one of the best among peers, and the management expects it to stabilise at 4 percent in the long-term.

However, given the limited listing history of both Aadhar and India Shelter, Home First remains at the top of the pecking order.

Bymoneycontrol