ITC: Steady performance by the core business supports margin profile

We remain positive on the long-term prospects of the business, given ITC’s healthy cash flow.

Key highlights

-

- Cigarettes volume growth beat expectations

-

- Sustained growth in FMCG and hotel businesses

-

- Agri and Paperboards saw sharp decline

-

- Remain overweight considering strong fundamentals

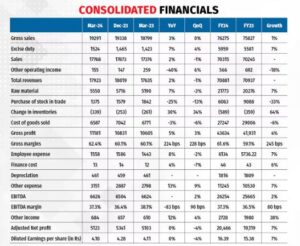

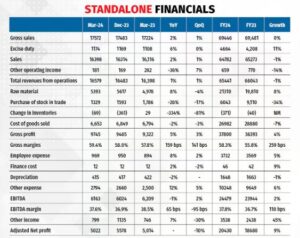

ITC’s (CMP: Rs 441; Market capitalization: Rs 5,50,826 crore; Rating: Overweight) consolidated revenue were below expectations. However, better volume growth in the cigarette business and gross margin expansion were positive surprises.

Consolidated revenue and EBITDA growth were flattish on the back of weak performance across Paperboard and Agri segments. The EBITDA margin remained stable around 37 percent.

Segment performance

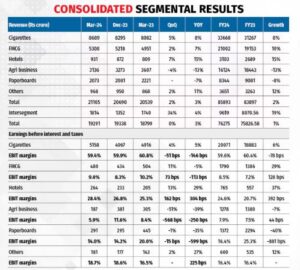

Cigarette volume grew in low-single digit, while higher EBIT was attributed to improved mix, strategic cost management, and calibrated pricing. Cost escalation of leaf tobacco and certain other inputs along with increase in taxes continued to impact margins.

Despite slow rural recovery, the FMCG segment saw healthy revenue growth and improved EBIT margins led by premium products. Food and home care categories outperformed personal care, led by modern trade and e-commerce channels, and higher rural penetration. With continued focus on new growth vectors, ITC launched 100 products in the last fiscal.

The Hotels business continued to outperform other segments due to a turnaround in the sector. The business, which is set to de-merge into a separate entity, has reported robust revenue and margins led by strong growth in the average room rate (ARR) and occupancies along with cost improvement.

The Agri business remained under pressure due to trade restrictions and the trend is likely to continue.

The weakness in the Paperboard business was largely led by lower realisations and cyclicality impact.

Gross margins saw sharp improvement, backed by backward integration with leaf tobacco, and Packaging and Paperboards businesses. This offers protection from the rise in input costs.

Outlook and valuation

As ITC continues to maximize the Cigarette category potential, the scaling up of the FMCG segment will drive the next leg of growth.

Innovations in the Cigarette business has led to superior product quality over peers, while integrated operation across the value chain has aided cost optimisation. ITC plans to maximize the business potential within the tobacco basket by countering illicit trade and fortify the market-leading position with product launches. The stable tax regime will also support the business.

FMCG growth story – The FMCG business remains a key focus area for ITC with higher brand investment, which has enabled the company to address the competitive intensity in this high-growth segment. Strengthening core brands, while addressing adjacencies and expanding new growth vectors will drive the growth in the segment. There is huge opportunity to tap in the premium packaged food segment, which is expected to outperform other categories, led by sustained urban demand, while better monsoon and the next government’s expected infrastructure push, post the election, will drive rural demand.

The Hotel business is poised for sustained growth on the back of a strong upcycle, coupled with ITC’s sizeable footprint and continued property addition. High-margin Agri products such as nicotine and its derivatives, and spices, with large export opportunity, will likely add to the bottom line in the medium term.

Although, the Paperboard business remains a drag on growth and profitability, domestic demand recovery could drive revenue growth, while the softening of input cost and lower pricing pressure due to cheap imports could aid margins in the near term.

We remain positive on the long-term prospects of the business, backed by sustained incubation of new high-growth businesses, given ITC’s healthy cash flow.

ITC is trading at a P/E multiple of 23x FY26 estimated earnings (versus 5-year average P/E of 34x). ITC remains our preferred pick with balanced opportunity of dividend income (3.2 percent dividend yield) and moderate stock returns for investors on the back of a well-diversified and fundamentally strong business model.

Higher margins in the non-cigarette FMCG business and the completion of the de-merger of the asset-heavy Hotel business could improve return ratios and lift valuation multiples.

Bymoneycontrol