Landmark Cars: Proxy to ride the premium PV trend

Anticipating growth in the luxury car segment, the auto retailer is expanding network.

Highlights

-

- In a sweet spot to capture the preference for premium cars

-

- Partnered with major luxury car makers in India

-

- Focus on continued expansion and growth by onboarding new OEMs

-

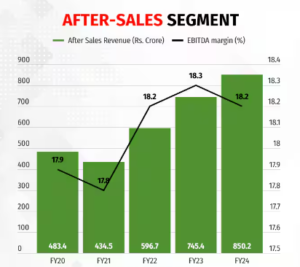

- After sales service a high-margin segment, witnessing strong growth

-

- Valuation at a significant discount to its peers

Landmark Cars (CMP: Rs 716, MCap: Rs 2,960 crore, Rating:), a leading auto retailer for premium and luxury cars in India, partners with major OEMs in the passenger vehicle segment, including Mercedes-Benz, Jeep, Honda, Volkswagen, and Renault. Recent additions to its portfolio include MG Motors, Mahindra & Mahindra, and BYD. In the commercial vehicle segment, it collaborates with Ashok Leyland.

Why should this be a part of the long-term portfolio?

Significant headroom to grow

Despite being the world’s third-largest car market, luxury car penetration in India is only 1 percent of total domestic car sales, far below developed economies such as the UK and Germany (15-25 percent), and emerging markets like Brazil, Thailand, and Indonesia (5-8 percent). This, coupled with the increasing consumer preference for premium vehicles, presents significant growth opportunities for Landmark Cars, which is strategically positioned to capitalise on this expanding market.

Strong portfolio of luxury car OEMs

Landmark Cars has a robust portfolio of original equipment manufacturers (OEMs) in the luxury car segment, featuring prestigious names such as Mercedes-Benz, Jeep, Renault, Volkswagen, and Honda.

Recently, the company has expanded its impressive portfolio by adding OEMs such as BYD, MG Motors, Mahindra and Mahindra, and Kia, thereby enhancing its presence across all key names in India.

Moreover, Landmark’s share of OEM sales in India is exceptionally strong, making it the number one partner for most of these OEMs.

Continued expansion to capture the growth

In anticipation of robust growth in the premium car segment, Landmark Cars is actively expanding its partner network and geographical reach. Alongside onboarding several new OEMs, as highlighted earlier, the company has increased its footprint by opening 20 new showrooms, workshops, and pop-up stores in FY24.

Going forward, Landmark is poised to continue its expansion trajectory by opening planning to inaugurate an additional 24 new facilities in FY25.

Slew of new products by portfolio companies

A key growth driver for companies in the automobile industry is their product pipeline as customers constantly seek new variants and products. The OEMs that Landmark Cars serves have a robust medium- to long-term product pipeline.

For example, Mahindra & Mahindra (M&M) plans to launch 16 models by 2030, comprising 9 ICE vehicles and 7 EVs.

MG Motors intends to introduce a new model every 3-6 months. Landmark now has 7 outlets and is opening 4 more in Mumbai and Ahmedabad.

Mercedes remains a top choice in the luxury vehicle segment, with 4 new high-end models set to be rolled out. The company is also opening new showrooms in Mumbai and Hyderabad.

Upswing in the high-profit after-sales segment

The after-sales segment not only offers a steady revenue stream but also contributes to higher-margin earnings, thereby aiding in mitigating the cyclical nature of new vehicle sales. Moreover, this segment has exhibited impressive growth in the top line and has a robust operating margin.

Moreover, the segment’s contribution to total sales has seen a notable increase, rising from 21.8 percent in FY20 to 25.9 percent in FY24, underscoring its sustained growth trajectory. Further, with an uptick in luxury car sales, the demand for after-sales services is expected to escalate, providing additional momentum to this segment’s growth.

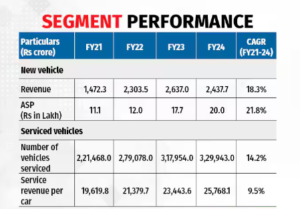

Lean balance sheet with strong growth

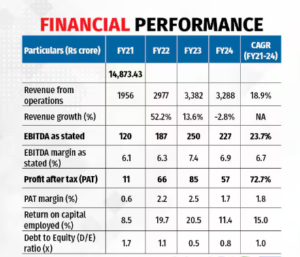

Landmark Cars has historically matched the growth of the premium car segment, as demonstrated by a 21.8 percent compounded annual growth rate (CAGR) in the average selling price of new vehicles from FY21-24. Its after-sales service segment also saw robust growth, with a 9.5 percent increase in per car service revenue. Additionally, overall revenue experienced an 18.9 percent CAGR during this period.

Moreover, Landmark Cars maintains a lean balance sheet supported by robust operating cash flows.

However, Q4 FY24 was challenging for the company due to slower-than-expected growth in some of its partner OEMs, such as Jeep, AL, and VW, which impacted its overall performance in FY24.

In terms of valuation, the stock is trading at 25.4 times price-to-earnings multiple for FY26e, which we believe is very reasonable, given the tailwinds of the industry, and future growth opportunities.

Risks and concerns

New vehicle sales contribute about 75 percent of revenue, making the company vulnerable to economic factors. Slower industry growth, rising commodity prices, and uneven income can hurt sales, while EV adoption could reduce after-sales service revenue due to their low maintenance.

Bymoneycontrol