Marico: Encouraging guidance, but valuation fair

Volume growth in core and acceleration in growth portfolio will be key.

Key highlights

-

- Uptick in rural demand

-

- Foods and premium portfolios to outperform core categories

-

- International markets improve

-

- Remain neutral, wait for better entry point

Marico (CMP: Rs 582; Market capitalisation: Rs 75,317 crore; Equal weight) posted mediocre results for Q4FY24. That said, the growth guidance for FY25, stability in raw material prices and improving demand trends in rural India led to a sharp stock rally, after results.

While we take note of management’s guidance, we would wait for a material improvement in the company’s core portfolio, before getting constructive.

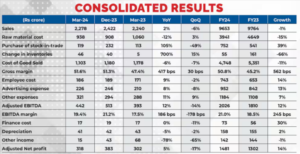

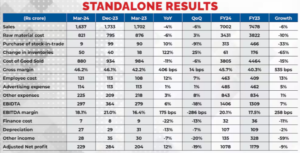

March 2024 performance

Consolidated net sales growth was muted on account of flattish growth in domestic revenues on the back of a 3 percent volume growth and price cuts.

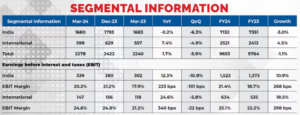

In the core portfolio, the performance of the hair-care segment remains subdued. Weak quarter for Parachute due to continued weakness in the mass segment, while Value- added Hair Oil (VAHO) also failed to perform due to a high base.

Continued price cuts led to a sharp decline in Saffola edible oil revenue, despite mid-single digit volume growth.

However, new growth engines — food business and premium personal care portfolio — saw continued growth.

Food business saw sustained growth, led by Saffola brands, with consistent improvement in profitability. The portfolio is likely to sustain 20 percent CAGR, with enhanced margin.

The premium personal care portfolio, including digital brands, saw healthy growth, led by digital-first brands, Beardo, Just Herbs, and Plix, They saw an improvement in exit annual revenue run rate (Rs 450 crore).

The food business and digital brands witnessed continued growth in scale and are projected to double in size by FY27 from the current levels.

The revenue contribution from the growth segments are expected to increase to 25 percent by FY27 (now 20 percent).

The growth in international business was 10 percent in constant currency (CC) terms, led by a recovery in Bangladesh on the back of softening inflation and improved business conditions. A strong growth momentum continued in South East Asia, Middle East and North Africa (MENA), and South Africa. The momentum will pick up in FY25, according to the management.

The expansion in gross margins is on the back of lower raw material prices and a favourable portfolio mix.

However, higher ad spends and other expenses have more than offset the benefit of gross margin gains, leading to a 180 bps sequential contraction in EBITDA margin.

Outlook and valuation

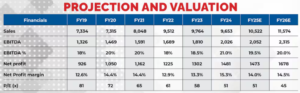

Marico targets low double-digit revenue growth in FY25, backed by high single-digit volume growth in the domestic business, primarily driven by the growth portfolio and continued double-digit CC growth in the international business.

Focus on revenue-led earnings growth: Addressing sales growth in the core domestic portfolio and diversification via growth segments will remain a key focus area of the management in the near and medium term. High-growth businesses are expected to drive profitability.

As copra prices saw some uptrend in the quarter, stability in raw material prices will remain a key factor. EBITDA margin is expected to sustain at current levels in FY25, backed by suitable pricing actions, while operating leverage benefits and premium products across domestic and international businesses will aid margins in the long term.

That said, the stock is trading at 45x FY26 estimated earnings after a strong surge in the stock price. While we like the improving business profile of new businesses, we remain neutral, on account of the valuation. Investors with a long-term view can accumulate the stock on market corrections.

Bymoneycontrol