Protean Tech – Should investors consider the stock even after muted earnings performance?

The company, with non-linear growth potential, is one of the best plays on India’s digital theme.

Highlights

-

- Protean is one of the cornerstones of the digital India evolution

-

- Revenue growth was healthy but employee expenses soared in FY24

-

- At present, three verticals contribute to revenue – tax services, NPS, and identity services

-

- Working on more segments for future diversification

-

- Protean is a technology service provider to ONDC, just like NPCI is to UPI

-

- Revenue opportunity from ONDC can be large

-

- Valuation premium justified

To be in sync with the fast-changing world, the investment process needs to be supplemented with a thematic approach, which seeks to identify stocks that could benefit from a particular trend.Many new trends have emerged — from renewable energy to artificial intelligence, but the one that can’t be missed is India’s digital journey. India’s digital public infrastructure (DPI) has grown rapidly and has played a key role in the formalisation of the economy. No wonder, finance minister Nirmala Sitharaman referred to the DPI as a new “factor of production” in the 21st century alongside land, labor, capital, and entrepreneurship.

In this context, one of the best stocks to play this theme is Protean eGov Technologies (CMP: Rs 1145; Mcap: Rs 4,634 crore; Rating: Overweight).

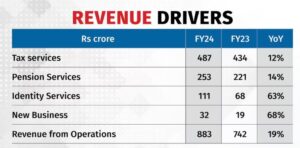

Protean’s revenues from operations increased to Rs 882 crore in FY24, a growth of 19 percent YoY. The increase in revenue was led by robust growth in identity services, partially off-set by a decline in tax services due to seasonality.

The revenue from identity services, which include e-Sign, e-KYC, online PAN verification, and Aadhaar authentication, saw a growth of 63 percent YoY, driven by the increasing penetration of digital processing of documents across government and private organisations spanning across activities like opening of bank account, digital lending, high-value transactions in the capital markets, jewellery purchase, real estate purchases etc.

While revenue growth has been healthy, employee expenses jumped 42 percent YoY in FY24 as the company has been investing in people and technology for future projects. Moreover, the provision for expected credit loss increased. Consequently, Protean’s net profit declined 9 percent YoY in FY24.

The provisions were in line with conservative accounting policies on receivables from the government/tax department. In this regard, it is worth noting that while Protean collaborates with the government in establishing the DPI, only 13 percent of the total revenue comes from the government.

A significant portion (around 80 percent in FY24) of Protean’s revenue is generated from offerings that are based on a per-transaction basis and the remaining 20 percent of revenue is annuity like.

The key question is why should investors consider the stock that has seen an earnings de-growth.

New verticals to drive future growth

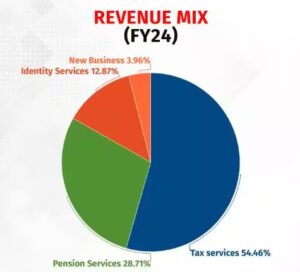

Protean’s current top line is contributed mainly by 3 business lines – tax services, NPS (National Pension System), and identity services. These verticals constituted over 90 percent of its total revenue in FY24.

The company has forayed into multiple new businesses and products. It is creating 3 more verticals – open digital ecosystem (ONDC), data (account aggregator), and cloud and infosec services.

Protean is the technology service provider that powers the entire network on which the ONDC ecosystem sits. This is just like UPI (Unified Payment Interface) being run by NPCI that enables the digital payments in the country.

At present, Protean provides the registry and gateway services to enable ONDC transactions for which it gets directly compensated by ONDC as a market institution. However, in the future, it could very well become a market participant compensated model just like the UPI. That’s because, by design, the government invests and creates the digital infrastructure and then the network participants pay for it on per transaction basis.

Another revenue opportunity from ONDC can be more on the lines of the SaaS model where Protean could be providing buyer and seller technology. The ONDC adoption and penetration is fast growing in the country and hence the revenue opportunity from it can be non-linear.

Likewise, Protean is involved in the creation of multiple open and interoperable stacks across diverse sectors agriculture, health, education, and skilling. Another growth lever for the company would be taking the entire stack of the 6-7 lines of business into international markets, especially into developing countries.

While the new verticals will contribute to future revenue, the existing verticals too offer immense growth opportunity.

For instance, Protean reported a 14 percent YoY growth in the NPS vertical in FY24, with more than 1.37 crore pension accounts opened against 1.22 crore in FY23. There is huge headroom for growth as pension penetration in India is just around 6 percent for private sector employees while in the US almost 70 percent private sector employees are covered under pension.

Protean has an account aggregator licence from the RBI and is also operating cloud and infosec services. India’s public cloud spending is expected to grow at a 27 percent CAGR from 2021-26

Overall, Protean’s multi-term population scale projects offer good revenue visibility and huge growth potential.

Valuation rich but justified

Protean is trading at 35 times FY26 estimated earnings. Valuation is rich but justified because of dominant market position in e-governance space, unique business moats, and tailwinds from growing digital penetrations.

While a thematic stock selection like Protean offers non-linear growth potential, it comes along with the uncertainties of unproven products and markets. Hence, only long-term investors should consider the stock.

Bymoneycontrol