Syngene: The preferred pick for sector re-allocation

This strong CRAMS play can benefit from the easing funding crisis in the biotech industry, and the shift in global supply chains, in the post-pandemic world.

Highlights

-

- Steep underperformance in last one year

-

- After general election, policy tweak towards social sector expected

-

- Defensive sectors likely to have higher allocation from institutional players

-

- China-plus-one trend and US Biosecure Act can strengthen order book

-

- Capex intensity remains firm to address emerging opportunities

-

- Invest for a suitably long-term investment horizon

Syngene (CMP: Rs 685; Market cap: Rs 27,580 crore), a leading CRAMS (contract research and manufacturing service) player, has significantly underperformed the broader equity benchmarks in the last one year.

The stock has corrected by 7 percent in the last one year but Nifty has moved up by 23 percent.

The reason for the underperformance was the funding crisis in the biotech industry. The broader benchmark indices, on the other hand, were supported by medium- term earnings prospects for sectors benefitting from government capex and policy initiatives.

However, after the general elections, compulsions of coalition politics may lead to policy backdrops getting tweaked.

Additional budgetary allocation and policy announcements to address the challenges for a K-shaped economic recovery are expected. In terms of portfolio allocation by institutional players, a re-jig is expected towards more defensive sectors for better risk-adjusted returns.

In this context, we prefer this strong CRAMS play, which benefits from the easing funding crisis in the biotech industry and the shift in global supply chains, in the post-pandemic world.

In addition, what caught our attention is the recent management comment on the step-up in funding in the US biotech industry. This should translate into new contracts and a better revenue profile later this year.

China-plus-one trend

Syngene can benefit from the firmness in the China-plus-one trend as market participants track the passage of the US Biosecure Act.

This proposed legislation aims to end government contracts for firms that have Chinese biotech companies, such as Wuxi Biologics, as suppliers. Hence, it has been reported that leading US pharma companies are looking for rival CRAMS players as partners.

In recent times, business inquiries/RFP have picked up which can potentially translate into new opportunities.

To meet this upcoming demand, the company has done some investments in recent years. It includes the acquisition of the biologics manufacturing unit of Stelis Biopharma. This facility is in the add-on investment phase (~Rs 100 crore) so as to be ready for biologics drug substance manufacturing capability by the second half of CY25. Thereafter, the company will seek client and regulatory validation to capture Zoetis-like opportunities.

The capex intensity remains steady with $60 million budgeted for FY25. This will partly be used to increase capabilities in the biologics side and to enhance discovery and development bandwidth.

Though the company has a limited exposure to China, it has worked out an alternative supply-chain network, which works as a proposition to clients looking to avoid China exposure entirely.

Another medium-term earnings driver to watch is the ramp-up in commercial supplies from the Mangalore API unit.

Pickup in orders from US biotech industry a key watch

Revenue guidance for FY25 is for high-single to low double digits, wherein the pick-up in momentum will be guided by orders from the US biotech industry and the Big Pharma.

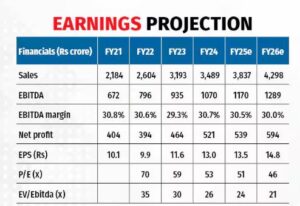

EBITDA margins are expected to be similar to FY24 (~30 percent) and net profit growth will be in single digit, given the higher depreciation from new assets.

The stock is trading at 21x EV/EBITDA for FY26e. While the valuation is at a premium to the sector, it is expected to sustain, given the drug research and development capabilities.

Bymoneycontrol