Tata Power: Powering ahead both in traditional, RE businesses

The company maintains better profitability on the back of strong growth and a higher scale across segments.

Key highlights

-

- Traditional core businesses post strong recovery

-

- Renewable business supports revenues and earnings

-

- Solar EPC business continues to attract large orders

-

- Strong capacity addition plans provide good visibility

- Stock trading at 16 times its fiscal 2026 estimated earnings

We have been quite upbeat about Tata Power (CMP: Rs 410, Market capitalisation: Rs 1,31,168 Crore, Stock Rating: Overweight) on the thesis that the company is a strong play on the green energy space and the turnaround in traditional businesses. The stock jumped from around Rs 257, when we gave the first positive update after Q2FY24, to a recent high of Rs 460 a share.

It is now trading at Rs 413 per share, which is about 16 times its fiscal 2026 estimated earnings. Despite the run-up in share prices, valuations are still reasonable in light of growth and an improving balance sheet.

Q4FY24 result analysis

During the quarter ended March 2024, the company reported strong growth in its clean energy portfolio, now at 5882 MW and constituting approximately 40 percent of its total capacity of 14707 MW.

Moreover, higher revenues from the discom business and a decent growth in overall power generation led to a 27 percent growth in consolidated revenues. Traditional businesses such as thermal power generation and coal did quite well because of strong demand and availability of resources.

In the renewables business, the solar EPC business during the quarter recorded a stellar performance with revenue growing 45 percent year on year, led by strong orders in hand and execution.

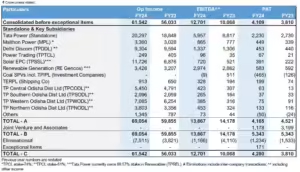

Thanks to the overall strong growth and a higher scale across businesses, the company was able to maintain better profitability. During the quarter, the consolidated EBITDA jumped 23 percent year on year. The biggest contribution came from the traditional standalone power generation and the coal businesses. At the net level, because of the higher deferred taxes on dividends, the company’s consolidated net profit recorded a 15 percent year-on-year growth.

Earnings outlook

In the fiscal ended 2024, the company achieved a fair amount of growth led by capacity addition and turnaround of the traditional business.

In fiscal 2025, the company is hopeful of higher capacity additions. Close to 5506 MW of renewable energy (RE) capacities are under various stages of implementation.

Initially, projects got delayed because of availability issues of key solar components. In the current year, it is expecting to add close to 2000 MW of RE capacity and a similar amount in fiscal 2026. This does not include the forthcoming 2800 MW pumped hydro power project.

Among the big projects in the current fiscal, the manufacturing facility for 4300 MW of solar cells and modules will be operational and achieve the desired utilisation by Q2FY25. This is going to provide strong support to growth.

The facility is taking off at a time when the company’s solar EPC business needs support to augment execution and scale, particularly to cash in on huge opportunities in rooftop solar. The company expects this to be an opportunity of 25000-30000 MW over the next 3-4 years. Tata Power has more than 13 percent market share in rooftop solar.

Bymoneycontrol