Diamond in the Dust | Coal India: A stock that’s a catch on every drop

E-auction premiums have normalised. Price hikes in the FSA segment is keenly awaited by the Street.

Highlights

-

- Higher manufacturing activity supports increased power consumption

-

- CIL’s production is set to increase in line with growing demand

-

- E-auction prices are likely to remain stable

- Dividend yield of 5-6 percent, valuation attractive

On the election verdict day, nearly all PSU stocks tumbled, and Coal India (CIL; CMP: Rs 441; Market capitalisation: Rs 2,72,330 crore; Rating: Overweight) was no exception.

The stock fell ~14 percent on June 4, 2024. However, we think the sharp fall in this coal major doesn’t hold a reasonable cause and the long-term story remains intact.

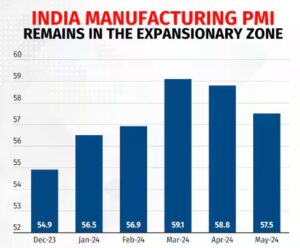

With a healthy growth in manufacturing activity, power demand from the industrial segment continues to rise. India’s peak power demand is expected to reach 260 gigawatts (GW) in FY24-25, rising ~7 percent YoY.

Although renewable energy is a theme of prime importance for the government, a good amount of new electricity will continue to get generated through thermal power in the next many years. Accordingly, CIL has planned to increase its production by 10 percent and 29 percent in FY25 and FY26, respectively, from the current 773 MTPA.

E-auction volumes remain healthy, and the premium has normalized at ~66 percent, as of Q4FY24, and it is likely to remain stable. Price revision in FSA (fuel supply agreement) is expected to happen after the general election.

With a dividend yield of 5-6 percent and a supportive demand environment, CIL, which is trading at 4.2x FY26e EV/EBITDA, appears attractive to be accumulated on any market correction.

Bymoneycontrol