Does Fedbank Financial deserve a place in the long-term portfolio?

Credit growth is expected to be strong and there is stability in margin and credit cost.

Highlights

-

- Tepid listing of Fedfina

-

- A largely secured asset book, growth momentum to sustain

-

- We see tailwinds in the gold loan business

-

- Margin should remain stable

-

- Credit cost to remain benign on steady asset quality

-

- Opex to moderate, expect uptick in RoA

-

- Earnings growth decent, stock should mimic the same

(Fedfina, CMP: Rs 141, Market Cap: Rs 5215 crore, Rating: Overweight), which recently got listed, had a tepid debut on bourses. The stock has since then been consolidating at the level of its IPO price. Post the listing, the company had announced it Q2 results that were decent. We examine if there is a case to consider Fedfina as a long-term portfolio stock.

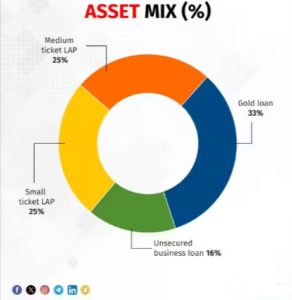

Fedfina is present broadly in four product categories and has a dominance of secured loans (close to 84 percent).

Robust growth to continue

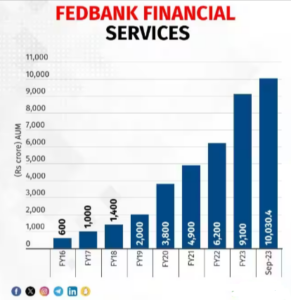

Fedfina has seen a strong traction in its assets under management (AUM) that have grown at a CAGR (compounded annual growth rate) of 47.5 percent in the past seven years — FY16 to FY23. At the end of the first half of FY24, the AUM crossed Rs 10,000 crore, showing a YoY growth of 38 percent.

The small size of the loan book — barely 30 basis points of the NBFC’s total advances — leaves ample scope for growth despite the heightened competition from banks and other NBFCs.

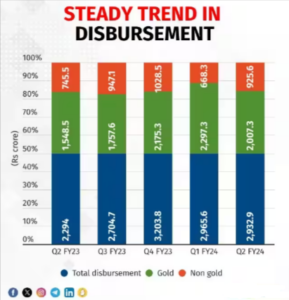

Disbursement too has been strong for both gold and non-gold loans.

Gold loan an attractive product

Fedfina has a strong presence in the gold loan business, which gives it a decent yield of close to 17.5 percent, much higher than what is charged by banks. To expand this business, the company has started co-lending tie-ups. Usually, the firmness in gold prices aids this business as customers can borrow more for the same quantum of gold pledged.

We, therefore, expect to see a strong traction in gold loans as well as non-gold where the higher level of economic activity in the second half of the year should help.

Spread expected to improve

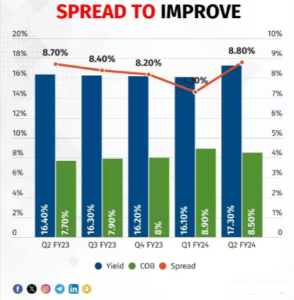

Thanks to the improving lending yield, Fedfina has managed to improve the interest spread despite the firming up of the borrowing cost. However, recent RBI guidelines on increasing the risk weight on lending to NBFCs could increase borrowing costs, given its large (close to 76 percent) reliance on bank funding. The liquidity infusion through the IPO (around Rs 600 crore) should act as a cushion and help margin gains in the second half.

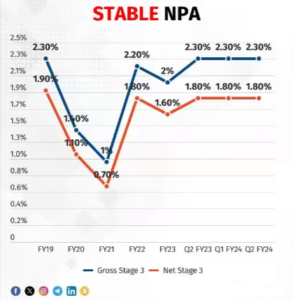

Asset quality – not much of a worry

With a largely secured book, there was no spike in asset quality that was seen in many unsecured-focused NBFCs during Covid. Gross and Net Stage 3 assets at 2.3 percent and 1.8 percent respectively have remained steady and early-stage delinquency (1 plus Days Past Due and 30 plus DPD) is also stable.

Credit costs (provision on bad asset as a percentage of loan book) that had spiked to 150 basis points in FY21 has now moderated to 60 basis points and should remain in the sub 1 percent zone barring any major black swan event.

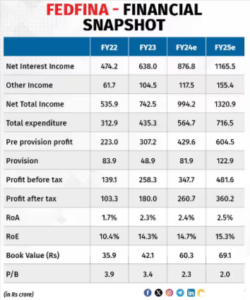

Credit growth is expected to be strong, there is stability in margin and credit cost, and operating expenses are expected to moderated as a large part of the IT implementation is over. Therefore, incremental opex is likely to be linked to business volumes. As a result, the company expects to end the year with an RoA (return asset) of 2.5 percent (2.4 percent in Q2).

We expect an earnings CAGR in the vicinity of 40 percent in the coming two years and the stock price will gradually take notice of the same. However, we do not expect meaningful multiple rerating.

Key risks

Growth challenges, steep rise in cost of funding or deterioration in asset quality.

Bymoneycontrol