Hindustan Aeronautics: Expansion in earnings to support higher valuation

Strong growth in orders, improving visibility, execution, and earnings augur well for the company.

Highlights

-

- Improving execution and orders in hand supporting higher revenue growth

-

- Lower cost and higher scale drive margins and earnings

-

- Earnings guidance remains strong on the back of current orders and execution

-

- Expanding production capacity to support growth and meet growing demand

- Stock reasonably valued in the light of earnings growth and balance sheet

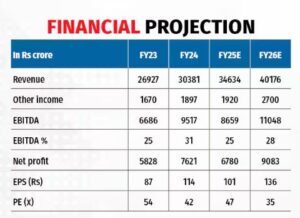

Since HAL’s IPO in 2018 at Rs 620 (post-split), MC Pro has been bullish about Hindustan Aeronautics (HAL) (CMP: Rs 4,825, Market capitalisation: Rs 3,22,671 Crore, Stock Rating: equalweight) on the back of good growth prospects, strong balance sheet, high entry barriers, cash reserves, and technical capabilities. In October 2023, the stock was quoting at around Rs 1900 and we wrote a note titled: “This defence stock gets it right for safety of capital, reasonable returns”.

The stock has done exceptionally well since then, now trading at a record high of Rs 4730 a share. We continue to remain bullish. Any correction could be used more as an opportunity to invest for the long term.

Improving execution to support higher growth

During the quarter ended March 2024, the company has delivered close to 18 percent growth in revenues. Strong orders in hand and execution have supported growth.

In fiscal 2024 too, growth was impressive at 13 percent on a year-on-year basis on the back of a few large orders such as Dornier Aircraft, and Tejas MK-1A. Moreover, led by the improvement in EBITDA margins of 1398 basis points, the company delivered 52.2 percent growth in net profit in the March quarter. Easing cost pressure, outsourcing, better management of internal costs, and higher scale helped the company achieve better margins.

With a higher scale and better margins, earnings’ momentum is expected to be strong. HAL’s current order book stands at nearly Rs 91,000 crore, which is over three times its fiscal 2024 revenue, ensuring strong

business certainty and visibility. With the orders in hand, the management expects to deliver double-digit revenue growth.

By the end of 2025, the company expects its order book to cross Rs 1.2 lakh crore. With another Rs 1.6 lakh crore worth of projects in the pipeline, the company is expecting the visibility to remain strong.

The new orders will cover a wide variety of aircraft, including training aircraft, light combat helicopters, utility helicopters, marine advanced helicopters, turbo trainers, and Tejas aircraft. Besides, the domestic markets, it is also working on exports and has already bagged a few orders.

Operating efficiencies to improve

It also believes that margins could be maintained at 25-27 percent over the next few years on the back of several initiatives (cost-cutting, sourcing, logistics etc) and the easing of cost pressures. The management highlighted that manpower cost, which used to be around 23 percent of revenue in 2019, has come down to 17 percent by the end of fiscal 2024. It is working on reducing it further along with working capital days, which will generate higher cash and returns.

Preparing for higher execution

HAL is expanding production capacities, including the development of Asia’s largest helicopter facility, which will initially manufacture 30 helicopters. This capacity will double to 60 helicopters following the second phase of expansion. The first phase is expected to be commissioned by October this year. Further, the company is expected to spend close to Rs 3000 crore annually on capex to increase capacities.

capabilities, HAL has entered into several joint ventures and signed multiple MoUs. It had signed an MoU with GE Aerospace to produce high-end GE 414 engines, positioning it among the few companies worldwide with such advanced capabilities.

HAL is also actively exploring export opportunities in markets such as Argentina, the Philippines, Egypt, South-East Asia, and other countries. In fiscal 2024, exports were merely 1 percent of the total revenue. However, with active participation and focus, it expects to achieve more in the coming years.

Bymoneycontrol